Strategic inventory planning centered on emotional value and competitive pricing will define successful holiday toy sales in 2024.

For retailers planning their 2024 holiday toy inventory, understanding this year's unique market dynamics is crucial for maximizing profitability. The post-pandemic toy industry continues to evolve, with clear consumer preferences emerging around price sensitivity, emotional connection, and holiday-specific purchasing patterns. This comprehensive guide synthesizes current market data and trend analysis to help retailers make informed buying decisions for the upcoming holiday season.

Market Outlook: Navigating Economic Realities

The 2024 holiday shopping season presents both challenges and opportunities for toy retailers. With inflation affecting consumer spending power, strategic inventory planning is more critical than ever.

- Price sensitivity dominates: Approximately 60-70% of toy sales now come from products priced under $10, as consumers across income brackets become more budget-conscious. This trend is particularly pronounced among households earning under $50,000 annually, who are allocating more of their budgets to essentials like food.

- Shorter selling season: The 2024 holiday shopping season is **five days shorter** than last year, compressing the traditional selling period and requiring earlier inventory preparation and more focused marketing efforts.

- Online migration continues: Among lower-income shoppers (under $50,000 annually), only 40% shopped online during the critical Thanksgiving period, compared to 60% of those earning over $100,000. This suggests retailers should maintain a balanced online-physical presence while tailoring assortments to different channel preferences.

2024's Trending Toy Categories

Emotionally Engaging Plush Toys

Plush toys offering emotional value and comfort have shown remarkable resilience against economic pressures. The category generated over 100% growth during recent promotional events, indicating strong consumer interest in toys that provide emotional connection.

- Notable performers: Brands like Jellycat and its vegetable characters (including the popular eggplant) with "bean eyes and enigmatic smile") have achieved cult status among adult collectors. These items maintain strong sell-through rates despite premium pricing.

- Opportunity for retailers: Stock a range of plush from impulse-price points ($5-15) to premium collectibles ($20-50) to capture both gifting and self-purchase occasions. Products with unique personalities or intriguing aesthetics often outperform conventional designs.

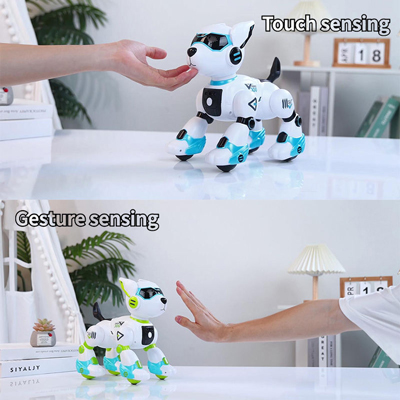

STEM-Focused & Interactive Toys

Interactive educational toys continue to gain prominence as parents seek products offering developmental benefits.

- Top performers: Tech-enhanced toys like the Fisher-Price Laugh & Learn Smart Stages Sit & Steer Driver ($39.99) and Spin Master's Bitzee Interactive Digital Pets ($34.99) combine play patterns with learning elements. These items typically retail between $30-60, representing a solid average selling price for mid-tier retailers.

- Sales growth evidence: The "electric and remote control toys" subcategory witnessed remarkable 176.95% month-over-month sales growth on prominent e-commerce platforms, signaling strong consumer demand for interactive play experiences.

Holiday-Specific Novelties & Decorations

Seasonal products capture impulse purchases and drive store traffic during the holidays.

- Christmas classics with twists: Traditional items like Christmas stockings ($2.42) and building block sets ($1.78) continue to sell in volume when offered at accessible price points. Products offering personalization options, such as monogrammed stockings, typically command premium pricing while maintaining strong margins.

- Outdoor decorations growth: Solar-powered Christmas items (like solar Christmas trees priced at $7.67) appeal to environmentally conscious consumers while addressing practical installation concerns.

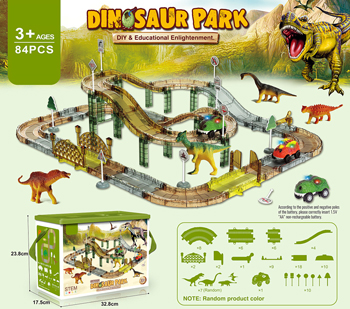

Social Media-Driven Novelty Toys

Products with viral potential on platforms like TikTok can deliver unexpected windfalls when properly leveraged.

- Recent successes: Items like wool-felt Christmas trees and full-size dinosaur race tracks have achieved sales growth exceeding 4,769% and 862% respectively after gaining traction on social platforms.

- Retailer strategy: Allocate 10-15% of inventory to test emerging viral products, focusing on items with visual appeal, unique mechanics, or participatory play patterns that translate well to short-form video.

Pricing & Assortment Strategy

Based on market performance data, retailers should structure their holiday assortments across three price tiers:

- Traffic drivers (Under $10): Representing 60-70% of volume, these items attract budget-conscious shoppers. Include impulse items, stocking stuffers, and basic playsets at this threshold.

- Core gifting ($15-40): This mid-range captures the majority of primary gift purchases. Focus on recognized brands, quality construction, and current trends within this range.

- Premium specialties ($50+): Reserve 10-15% of inventory for higher-ticket items that demonstrate clear value through licensing, technology, or collectibility.

Key Dates & Inventory Planning

The compressed 2024 holiday season requires precise timing to maximize sales opportunities:

- Early October: Have Halloween inventory positioned and begin promoting holiday items

- Mid-October: Launch holiday toy catalogs and promotional materials

- Early November: Ensure full holiday assortments are available for the Black Friday/Cyber Monday period

- Mid-December: Restock fastest-moving items for last-minute shoppers

Partnering with Reliable Suppliers

In an environment where product heat and visibility significantly impact sales, choosing suppliers capable of responding to trend shifts becomes increasingly important. The most successful retail partners will be those offering:

- Flexible minimum order quantities enabling retailers to test new items without excessive risk

- Responsive production capabilities to capitalize on emerging trends

- Compliance expertise ensuring products meet all relevant safety standards

- Marketing support including product imagery and video content optimized for social media

The 2024 holiday season rewards retailers who balance pragmatic pricing with emotionally resonant products. By focusing on inventory that delivers value across multiple price points while capturing the imagination of both children and adults, retailers can navigate economic headwinds while achieving sustainable profitability.

For more detailed information on specific product recommendations or to discuss customized assortments for your retail operation, please contact our wholesale team.

Post time: Sep-25-2025